Investment and profitability

The minimum investment in “DSK Stability - Eurobonds” is 255.65 eur per deal. The minimum amount for redemption order is 255.65 eur per deal.

The recommended investment horizon should be consistent with the duration of the "limited period" of the Fund's activities to achieve the optimal result of the investment – till 13 June 2027, incl.

The expected return on an investment in units of DSK Stability - Eurobonds can be linked primarily to the yields of the bonds included in the fund's portfolio.

Protection of investment appreciation means that the net asset value per unit (NAVU) calculated as of the last business day of the "limited period" is not less than 103% of the NAVU calculated as of the last business day of the "open period"

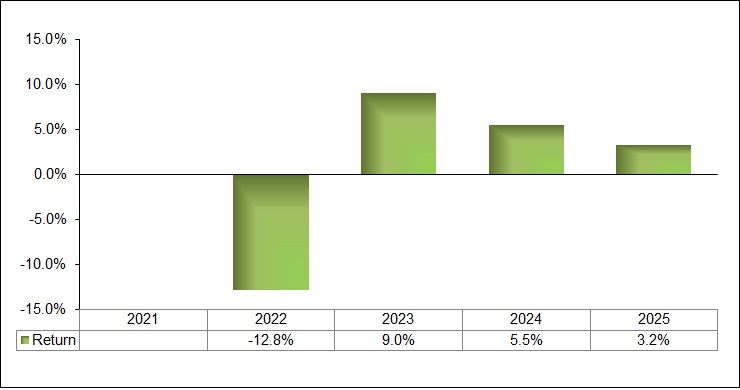

Past performance is not a reliable indicator of future performance. Future market dynamics may be very different from those observed.

The fund was established in August 2021 and began issuing units in September 2021.

Investors should have in mind that the value of the funds’ units and the income from them may decrease, the profit is not guaranteed and they take up the risk of not recovering their investment in full. Before making a final investment decision, it is advisable for investors to familiarize themselves with the Prospectus and the Key Information Document of the respective fund. The documents are in Bulgarian and they are available on the website of DSK Asset Management AD (www.dskam.bg), and upon request can be obtained free of charge on paper at the office of the Management Company or at the offices of the DSK Bank AD, designated as a distribution point, every working day within their working hours.